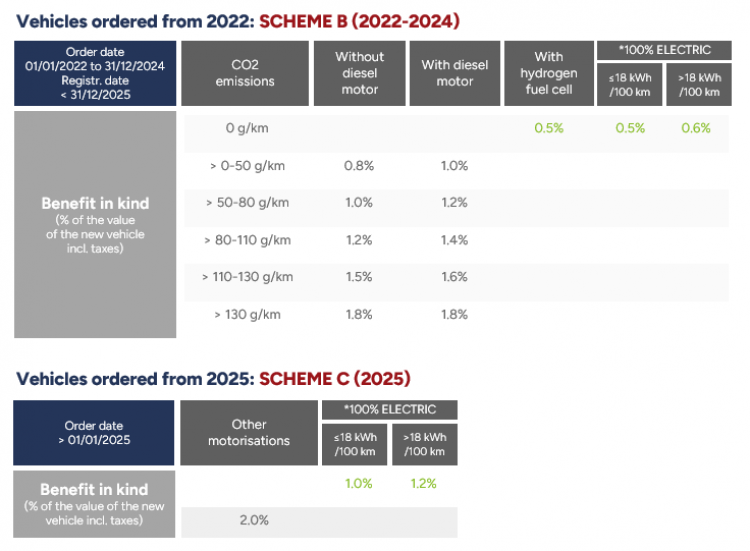

For company cars registered from 1 January 2025 onwards and for which no contract is signed before 31 December 2024, the flat-rate system of the benefit in kind will be simplified.

Currently, the benefit in kind is taxed at a flat rate of 0.5% (for consumption ≤ 18 kWh/100km) and 0.6% (for consumption > 18 kWh/100km) for electric vehicles, and at a flat rate of between 0.8% and 1.8% for internal combustion vehicles.

From 1 January 2025, the benefit in kind will be taxed at a flat rate of 1% (for consumption ≤ 18 kWh/100km) to 1.2% (for consumption > 18 kWh/100km) for 100% electric cars, and 2% for other types of combustion engine. The aim is to encourage employees to opt for a company car with zero CO2 emissions.

Some examples of figures:

1 BEV - consumption ≤ 18 kWh/100 km

2 PHEV - CO2 emissions: 20 g/km (applicable for scheme B)

3 Petrol - CO2 emissions: 111 g/km (applicable for scheme B)

It is still possible to anticipate this change because an order with the signing of a lease contract before 31 December 2024 will allow the current rate to be maintained. Renewing the lease in 2024 for the entire duration of the contract will be more advantageous, even if the vehicle is delivered in 2025.

View the document from the Ministry of Mobility and Public Works: Avantage en nature 2022.pdf

For more information on benefit in kind regulation: legilux.public.lu

We offer a wide range of electric cars for leasing at competitive commercial conditions, including government subsidies for the purchase of 100% electric vehicles.

Fully electric cars are accessible and affordable, with the majority of our core range offering autonomies of 450 to 550 km. They are also increasingly comfortable, with engine power generally superior to that of a similar combustion-powered car, and moreover immediately available, for more dynamic driving pleasure with complete peace of mind.